REDUNDANT OFFICE SPACE

A burgeoning quantity of older and empty office spaces has remained available in the years since the pandemic and has become a concern for developers and policymakers alike, as vacancy rates have risen in the core markets such as the City and Canary Wharf. There is 77% more available office space since the start of the pandemic, with much of it verging on the obsolete for modern occupiers. As working from home policies continue to play out and the way in which the workforce engages with the office continues to evolve in terms of location, size and flexibility, the volume of available space will remain high.

Meanwhile, the sustainability of central London’s office footprint has also come under a microscope as ESG goals have become more of a priority for businesses. This has not only reduced occupier appetite for the less sustainable spaces, but government policy has meant that many buildings with poor EPC scores are deemed unlettable. As the push to net zero ramps up, a question mark remains over what is to be done about these vacant spaces. Many have argued that the answer to this lies not in bringing this stock up to a higher standard, but in changing its use altogether.

CHANGE OF USE

Conversion from offices to an alternative use is not new but doing so from a planning perspective has proved difficult. From the 5th March 2024 this process is being made easier as regulatory changes come into effect, allowing more office-to-residential conversions to go ahead with amendments to the permitted development rights of Class E Offices to Residential. Specifically, the changes will see the floorspace limit and vacancy period requirements be scrapped, bringing a greater number of office spaces within the scope of conversion.

The past few years have seen a number of office conversions to a range of different uses including residential, hotels and laboratory space as higher demand for these uses outweighs that for offices. The appetite for city centre living has returned, but supply for all types of housing from affordable to luxury is low. Many market commentators have suggested that conversion may be the answer to the current housing crisis, with CBRE’s latest report suggesting that if the entirety of London’s secondhand office stock was converted to residential, this would amount to 28,000 new homes, going some way to meeting the 90,000-100,000 homes a year that Savills predict is needed to fill the void. In 2023, the buildings that have been converted or are imminent include 131-133 Cannon Street, 3 Albert Embankment and 149 Old Park Lane.

Converting to other uses such as lab spaces can provide the catalyst to breathe new life into an existing business district. The creation/consolidation of life sciences clusters in areas such as Canary Wharf has already acted as a significant draw for life science occupiers with British Land having recently announced the conversion of office space at its Regent’s Place campus. Changing use would also act to diversify the offering in central London, with the conversion to hotels or retail catering to a wider variety of central London workers and visitors.

WHAT ABOUT OFFICES?

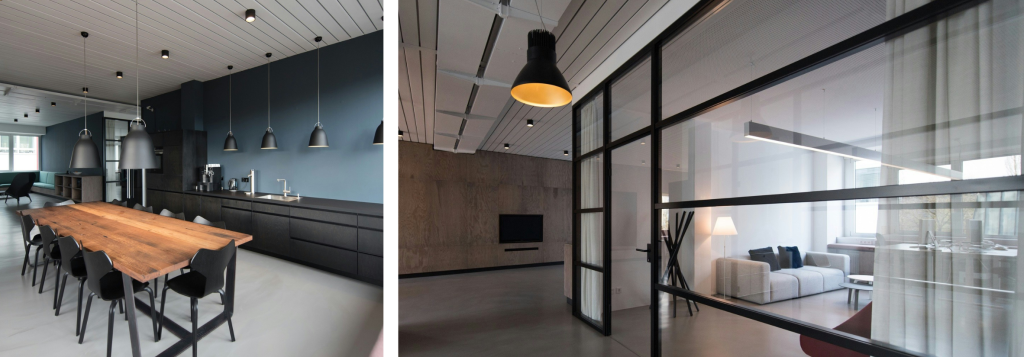

While the possibilities for office conversions are set to be easier and wider, is conversion itself the best move forward for the office market? The readiness with which some developers are recommending a change of use is somewhat disappointing as older office properties can often have more character and have become part of the local community. Many of the office buildings that have been converted over 2023 have been between 10-20 years old and located in markets that continue to attract occupiers. Therefore, it would not take a great deal of investment to refurbish these buildings to the point where they would not just meet EPC requirements but would provide a suitable option for occupiers looking for spaces in amenity-rich areas – which on its own is a requirement for the workforce.

Whilst office conversions are often presented as a somewhat straightforward proposition, this is far from the case. Although the process is simpler for some use types than others, for example from office-to-lab space as opposed to office-to-residential, these uses all have very different requirements to offices when it comes to ventilation and natural lighting for example. As such, once an office conversion is made, it is very unlikely that this process will be reversed, curtailing availability in the long-term and thus occupiers’ choice. Said long-term reduction in availability will also likely lead to increased rental pressure, with occupiers finding that they are paying more for those previously affordable spaces.

A CHANGE OF APPROACH

Ultimately, the benefit of converting office spaces into alternative uses lies with which office spaces are converted. Older and secondhand buildings encompass a broad range of spaces, from the poorest quality to good quality spaces in desirable locations that are not quite up to best-in-class standards. Therefore, while conversion would likely be the best course of action for those poor-quality spaces in undesirable office markets, treating all secondhand spaces as a target for conversion will deprive businesses of many office spaces that hold great potential to cater to the modern occupier. On this basis, to create a truly desirable and sustainable office market, we expect developers to first look at bringing stock up to standard as opposed to searching for other uses.