Central London Q3 2019 Office Rent Guide

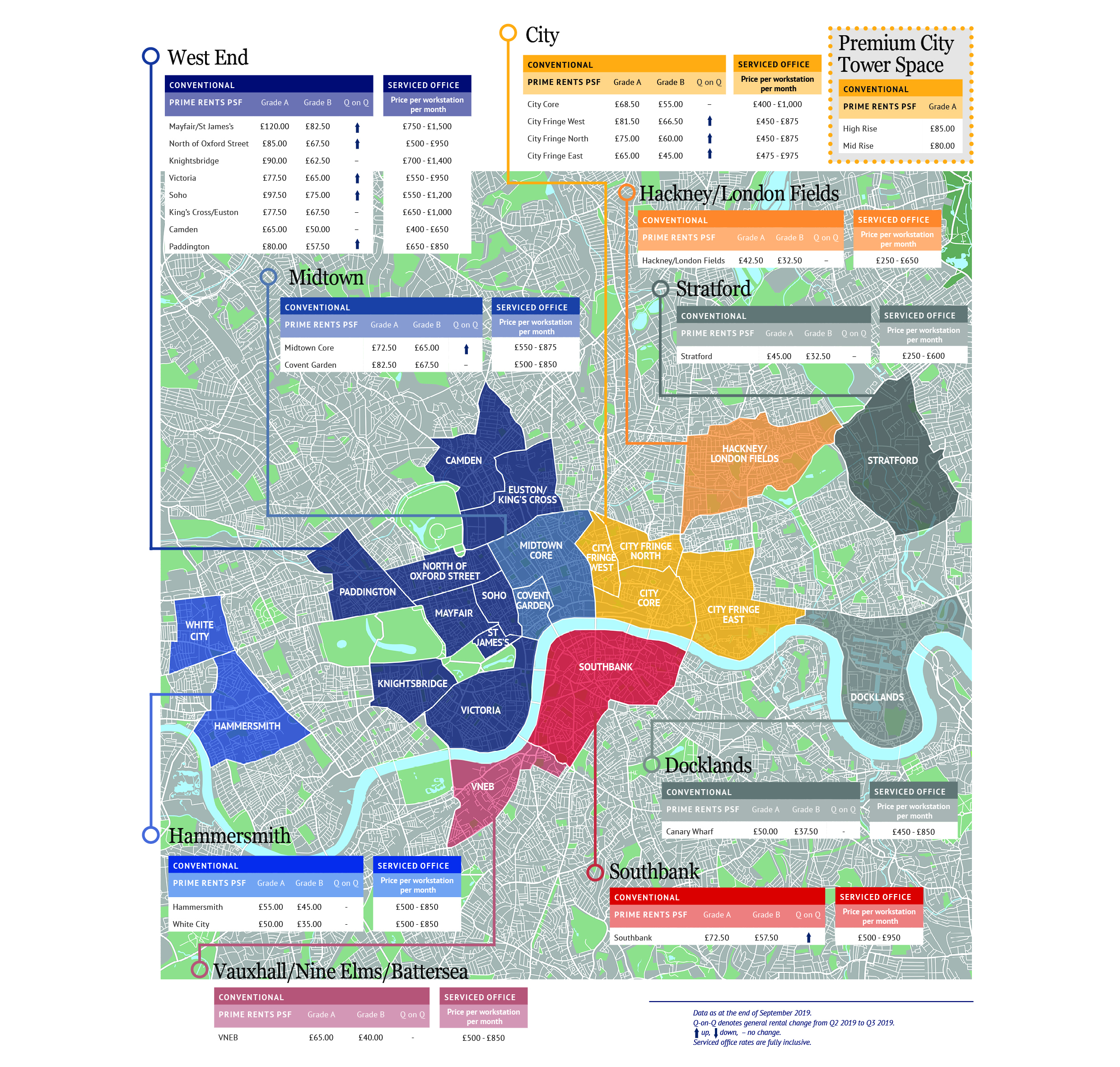

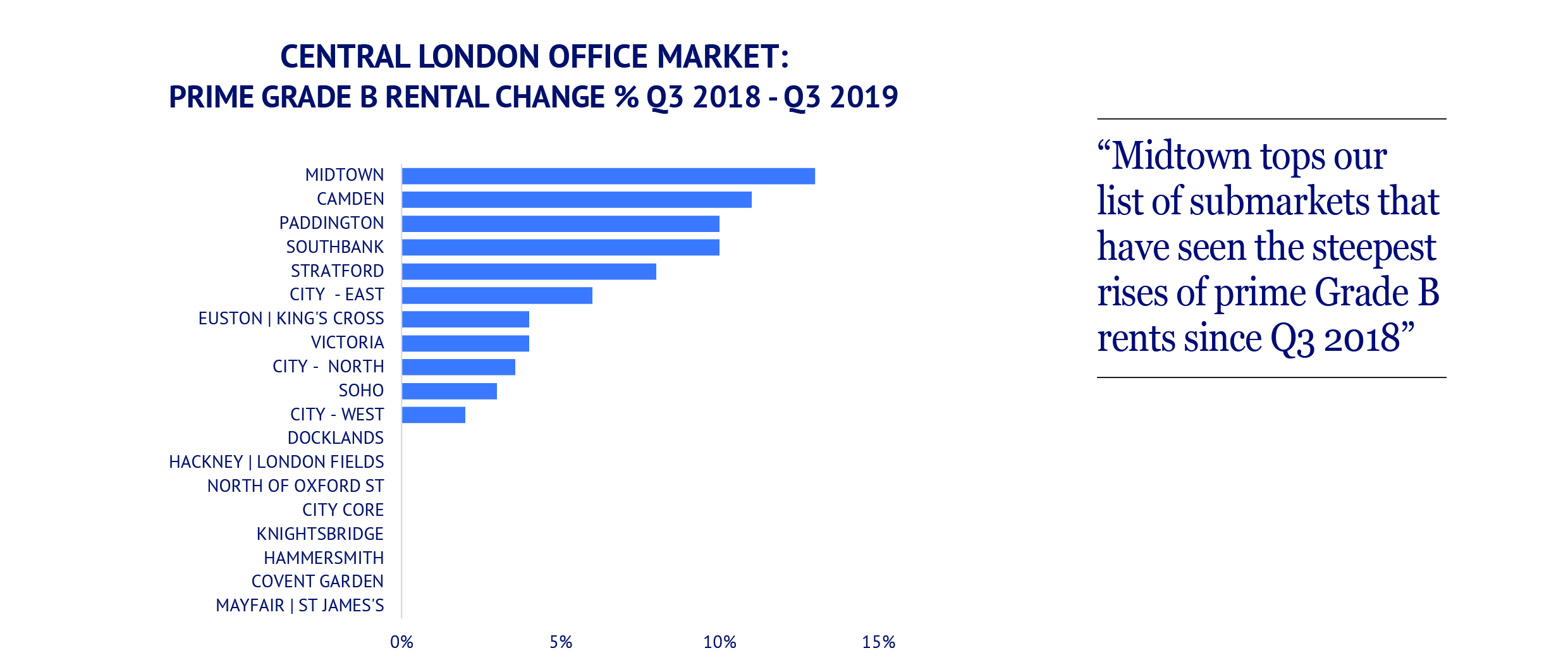

In our predictions report earlier in the year, we suggested that the dichotomy of the London office market could lead to both rental decline and rental increases across the year. Whilst the occurrences of rental decreases have been few and isolated, increases have been a little more widespread. Average prime rents both Grade A and B across central London submarkets have increased by 1% in Q3. Yet, it is Grade B prime rents that have ratcheted up this quarter and over the past year as the impact of demand filters through.

Grade B prime rents have risen in eight submarkets across Q3, with Paddington and Southbank moving out by 5%, rents for both are now pegged at £57.50 per sq ft. Setting new historical highs for this quality of space in these

locations. This trend is also evident in other traditional submarkets such as Victoria, Soho and North of Oxford Street. Yet it is the change over the past 12 months that gives an indicator of where tenant demand has been eroding choice and future demand is focused on both impacting rental levels to such an extent that rises have been inevitable.

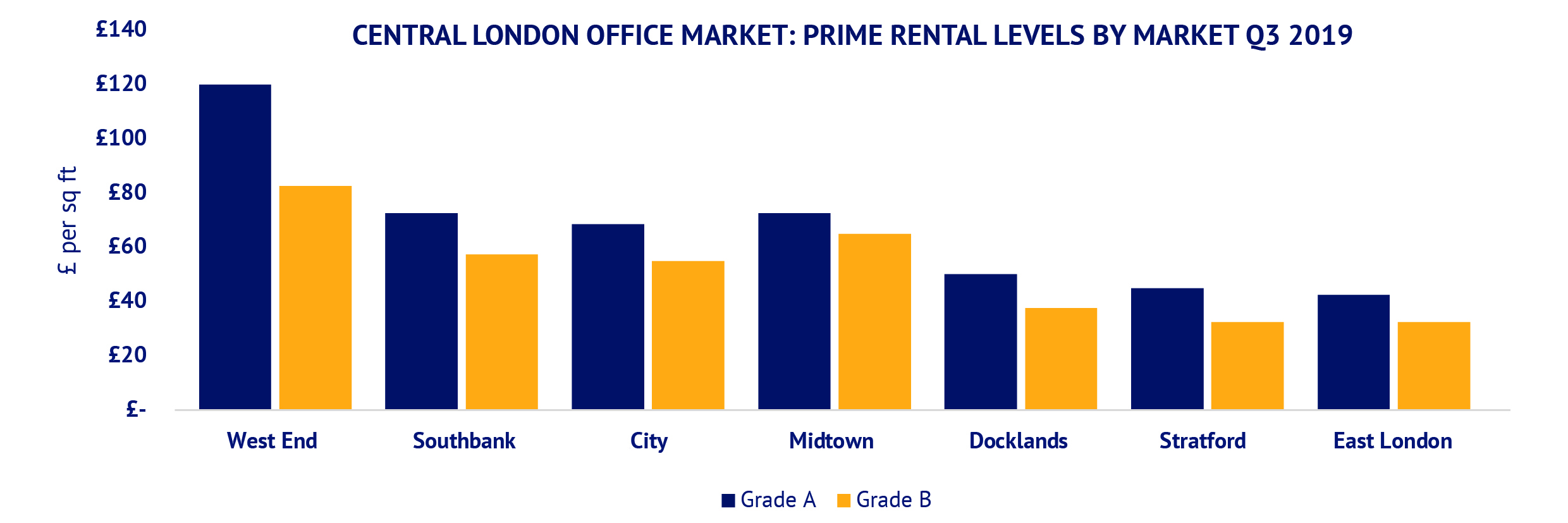

Midtown tops our list of submarkets that have seen the steepest rises of prime Grade B rents since Q3 2018, now at £65.00 per sq ft represents a 13% increase. This level is not just catching up with the rents in neighbouring Covent Garden but now surpasses those in the City Core. Signalling a shift to rents in western submarket rather than those more eastwards.

Double digit Grade B rent growth has been recorded in the less core submarket of Camden, up by 11% over the year. Now commanding rents of £50.00 per sq ft. A level which is in excess of more established areas such as Hammersmith, Aldgate and Canary Wharf. The aforementioned submarkets of Paddington and Southbank have notched up 10% growth over the same period, largely as a result of low levels of availability.

Other movements of note in Q3 include Prime Grade A rents in Mayfair – St James’s are now at £120.00 per sq ft, whilst high are still 4% below the level at the same point last year. But, the greatest jump in Grade A prime rents this quarter has been in the City – East Fringe area of Aldgate/St Katharine Docks. Now at £65.00 per sq ft, 7% up on the previous quarter and 13% up over the year. This has been influenced by the bar in quality buildings being raised in recent months.

In general, the movement of rents are indicating a shift of power increasingly resting with landlords. However, demand could harden over the coming months, with only 1.9 million sq ft under offer and uncertainty emanating from the upcoming General Election and ongoing Brexit could subdue some of the growth we have been seeing.

Office HQ

Baird House,

15-17 St Cross Street,

London, EC1N 8UW

Contact

© 2024 Devono. All Rights Reserved / Data Protection License Number: ICO:00044152981

Regulated by RICS